Are we really living in the age of decadence? In response to this well articulated NYT piece from Ross Douthat, “the Age of Decadence“, that I encourage you to read beforehand.

Thanks to a good friend this article brightened up my break of day – so to speak – today.

The macroeconomic cycle

I will argue we are not living in decadence.

While I fully agree on most of the premises, I don’t buy in some of this article’s conclusions.

Granted: the macro economic cycle isn’t looking particularly bright and there has been for years a huge east-west trade imbalance.

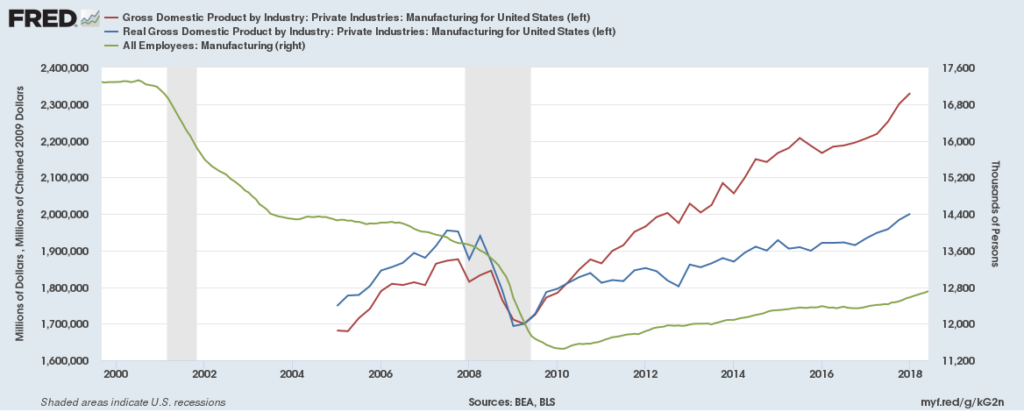

At the same time few people are aware that US manufacturing output – far from having declined – is at an all time high.

US Manufacturing output

What has kept going down is not output but employment, thanks to improvements in technology and the switch from labor intensive industries to capital intensive ones, beside demographics. Exactly what you would expect in a mature economy doing its best to take advantage of its leading position.

We have certainly created our own competition by investing heavily in production facilities in Asia. But that goes along with capitalism, that is always looking to take advantage of the cheapest and most efficient production factors, and is always looking for growth.

Where to look for opportunties?

Where domestic growth stagnates, capitalism goes international. Nothing beats a new market to be created and saturated, and this has been going on since the age of colonialism. Alas, a very finacialised economy such as the US – with EU not being very different – does not leave a lot more room for growth.

We have thus effectively planted the seed of our own demise, and the plant eventually has developed enough to shade and outgrow its own parent. This was especially true for an economy like China that – unlike western ones -masters the art of the long view in economics.

At the same time, the economy also does wonders with comparative advantage. If I am better at producing bananas and you are better at producing apples we are both better off if we concentrate on our best abilities and trade our surplus for other goods and services. This is globalisation and liberalism – especially in the hyper version now in vogue – in a nutshell.

In short, we have done what was right do in the system we have created, but the system in the long run worked against its very own interests. Taking for granted that the idea behind the system is to maximise wealth and well being.

So why has growth stalled in western economies and why has the west been unable to match growth in the rest of the world?

The reasons behind stagnation

Growth has stalled because we are mostly mature economies and – as such – there is only so much we can consume. Once an average family owns a second car, it will find it hard to justify a third one on the basis of need to use alone, at least. On so goes for most other items.

We are stuffed with goods.

We might buy and consume more if we had more free time, but the western model also dictates that we work our 40+ hours week. And very little consumption goes on when you work besides caffeine.

This limited scope for growth effectively creates a catch-22. You can still move upmarket, buying nicer stuff, but as far as basic, primary, secondary and even tertiary pavlovian needs are concerned, we are mostly well equipped in the west. At least those who manage to stay in the workforce.

On the other hand, in fact, workforce is shrinking, and this is not just demographics. The same law of minimal costs and efficiency that permeates our international efforts is also at play at home. We make our industries more efficient and more technological and this most times implies that they also require less work and less workers for unit of production.

So, using and adagio now in vogue, “this time it’s different”.

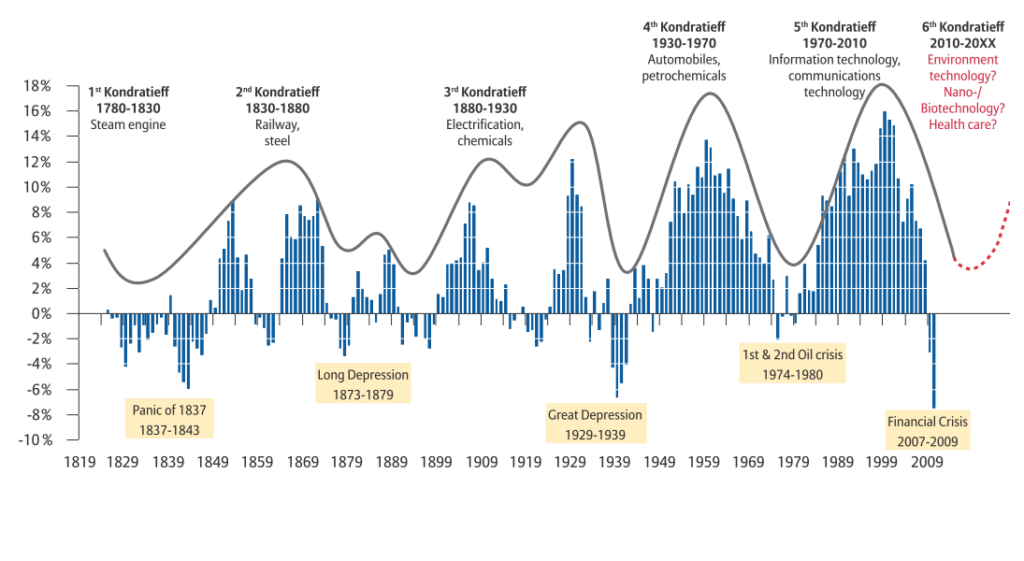

So far we have been riding 7 or more Kondratev technology waves of disruption, from railways to electricity to mobile phones and so on. Each time the disruption has been balanced with a shift in employment’s type and quality, but the numbers have always spiked up. It was thus possible to end animal labour, end slavery, empower women, urbanise peasants and farmers, all of the above products of the economy more than the touted signs of social progress we often recount ourselves.

This times it’s different

It’s different because work gets out of the equation, as it’s not needed anymore. The AI revolution – do check earlier blog articles if you want to read more on the topic – is making not just blue collar but white collar work obsolete. The professions that will hold up longer – no one knows for sure, but that is the shared view at least – are those involving people management, relationships and creativity. All rest will easily be mechanised away in time.

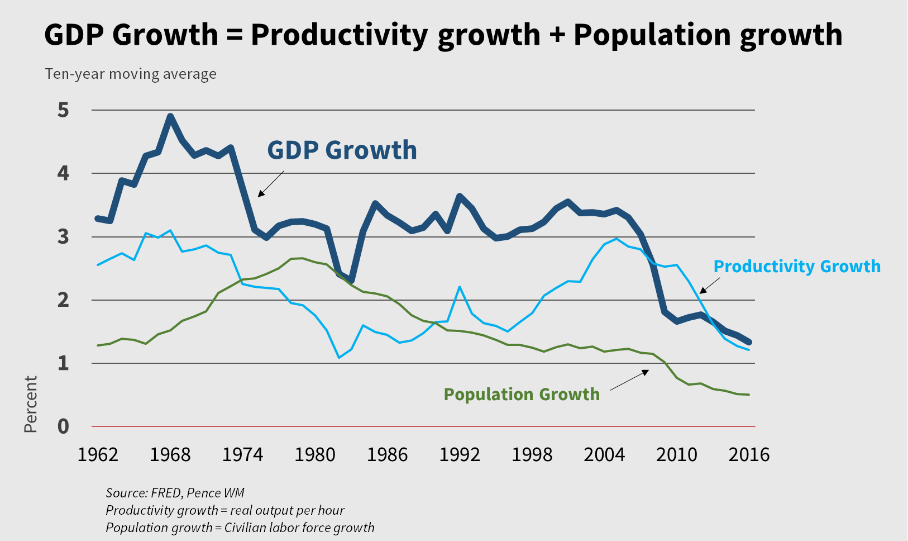

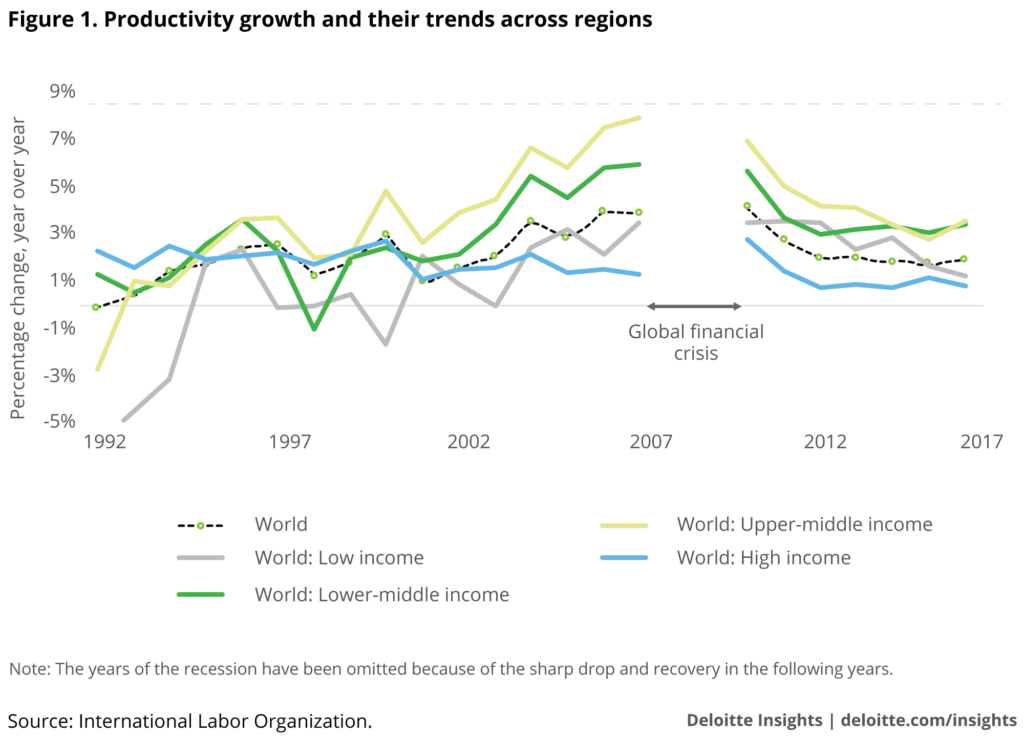

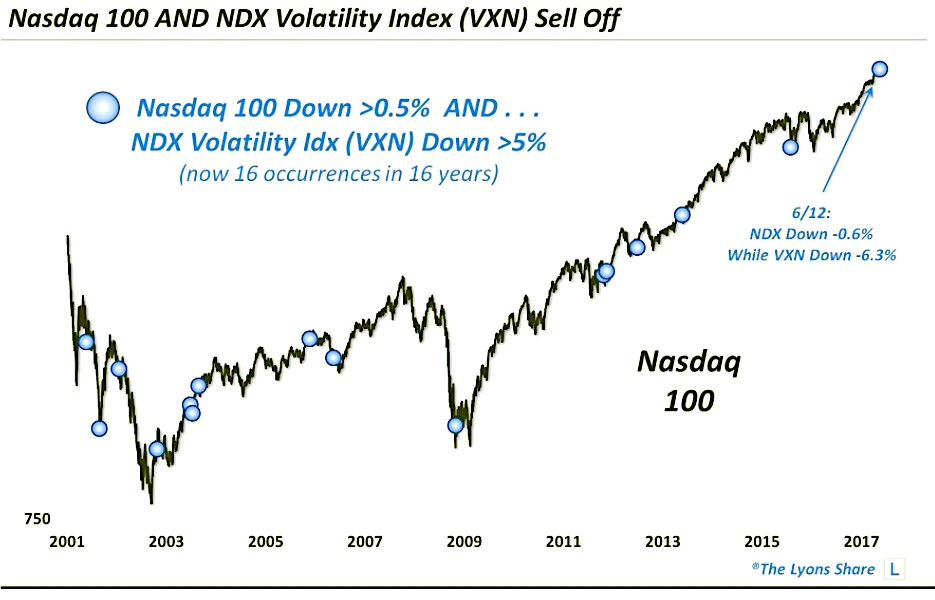

We already see the effects of this run for efficiency and the massive deployment of ICT in industry in terms of the long term decreasing trend in employment. Productivity is slightly different: it’s actually been decreasing. But the productivity conundrum baffled economists in the early 2000 (eventually they discovered that they were not reading the number correctly and efficiency was there), and so is this sluggish productivity baffling economists now at the onset of the AI revolution

So is decadence to be read into this long term loss in productivity?

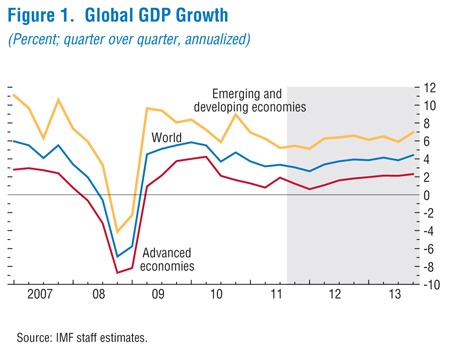

I will argue that the decline we are observing now is more an effect of the financial crisis of the 2008 from which global production and commerce has not yet fully recovered than anything else. Financial steroids have ceased stimulating artificial growth into the economy, and after the first large correction of 2008-2010, this has also determined long term consequences. The very conservative and at times negative outlook taken by investor on the future has done the rest, severely limiting investments, already crippled by the credit crunch.

The bubble economy

Back to the internet economy and the examples of excesses heralded by Douthat: the Fyre Festival, Theranos and Uber.

The rational shedding light into these events here is slightly different: the need for speed, or more precisely, pace.

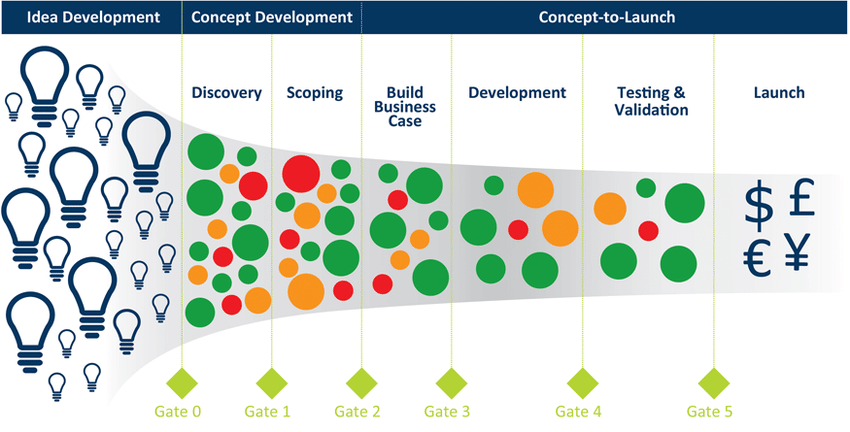

The internet economy, after having caught off guard big finance in its inception in the 50′, evolved into a giant funnel of value creation.

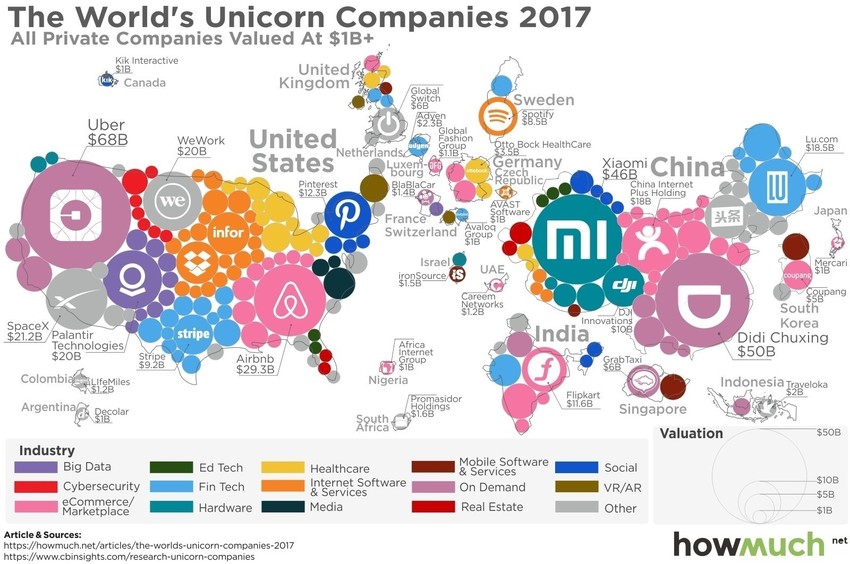

In an economy that fails to grow – mostly for being saturated as we have seen – the internet economy presented a gigantic opportunity for growth. This now semi-mythological world of technology has its heroes and villains, but most of all, is surrounded by those who never stand loose, a vast array of on-feet-landers. Among those, the professionals who stand to profit almost no matter what the outcome of the initiative turns out to be, good or bad: lawyers, venture capitalist (if they get it sometime right), tax accountants, risk assessors, insurers, financiers, bankers and so on. Let’s leave out for the time being the investors class, but unduly so.

If you are wise enough to spread your investments wisely and you are not standing in front of a recession with an outlook of 2-3 years, you are bound to make – on average – to make pretty good money.

The value funnel exists, the magic wand that helps the invisible hand take its course of action. Alas, San Francisco, we got a problem!

The problem is the funnel obviously needs to be fed.

Time to go somewhere else?

Even the US that counts a hefty population of 330 mln can only generate so many rockstars, after accounting for the substantial borrowings of talent it enacts with its skilled and successful immigration policy, mostly untouched even in Trump times: you seldom have an incentive to cut the grass from growing under your feet.

The skilled labour population shrinks and the cost of a SW engineer or a computer scientist in its nobler version in certain parts of the US is out of bounds. The population of genius entrepreneurs is fully tapped into. As a result, ideas start to dwindle and less than perfect ideas and propositions start to be fed into the funnel to generate value.

After all there is nothing worse than standing idle for all those who are responsible with nurturing the funnel.

The result of these trends has been double fold.

On one side we see less opportunities getting to market

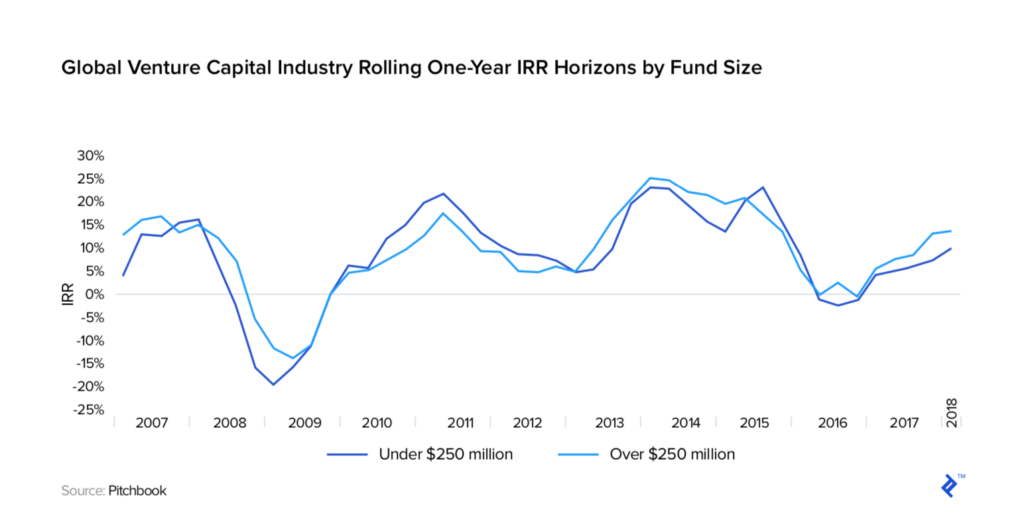

On the other hand we also observe a rock and roll trend in VC returns, that have taken a very large dip from their long term average.

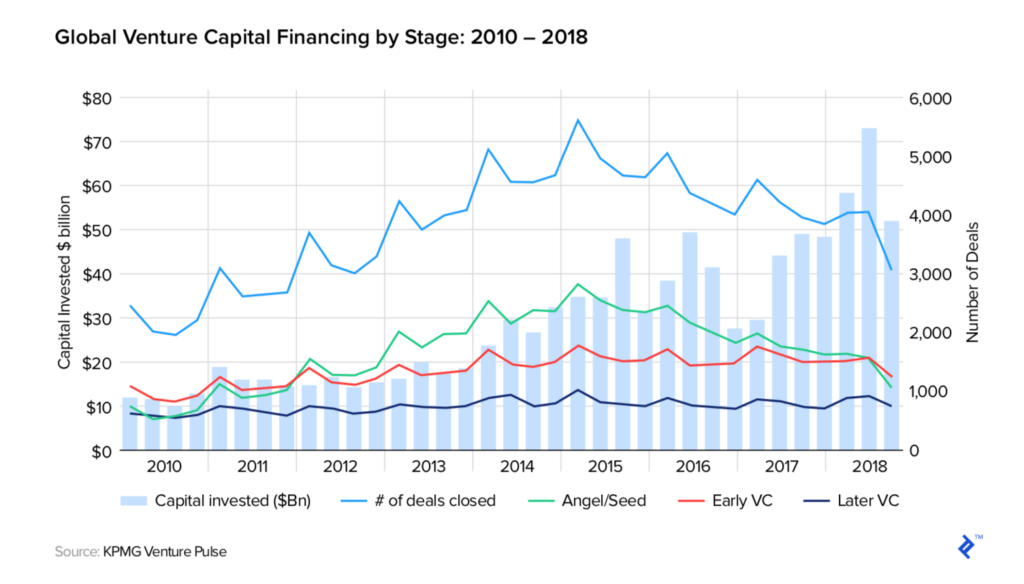

With less investable opportunities and plenty of capital to go round, it’s only logic that funds look for scale: fewer bets receive more funds.

International business creation

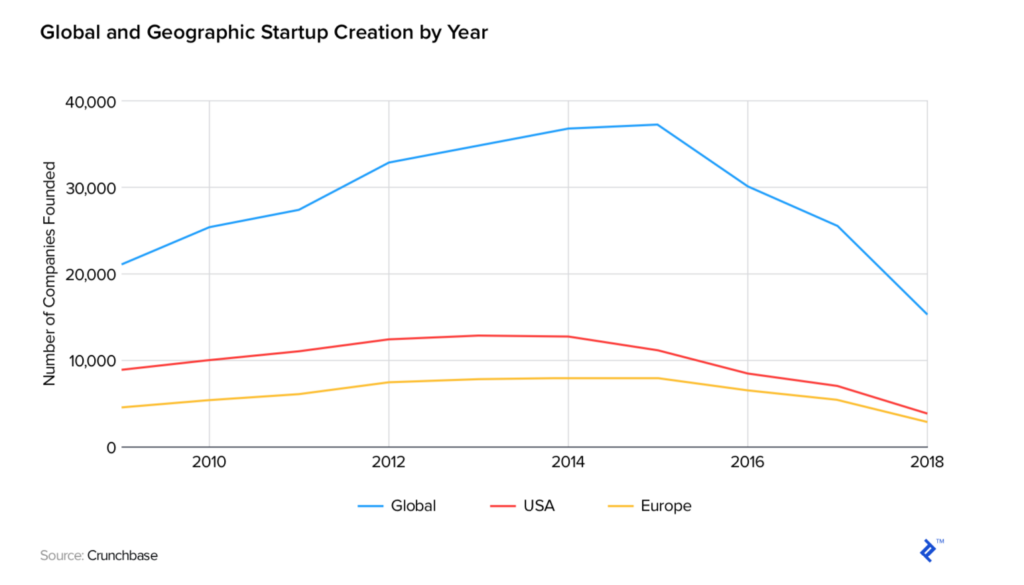

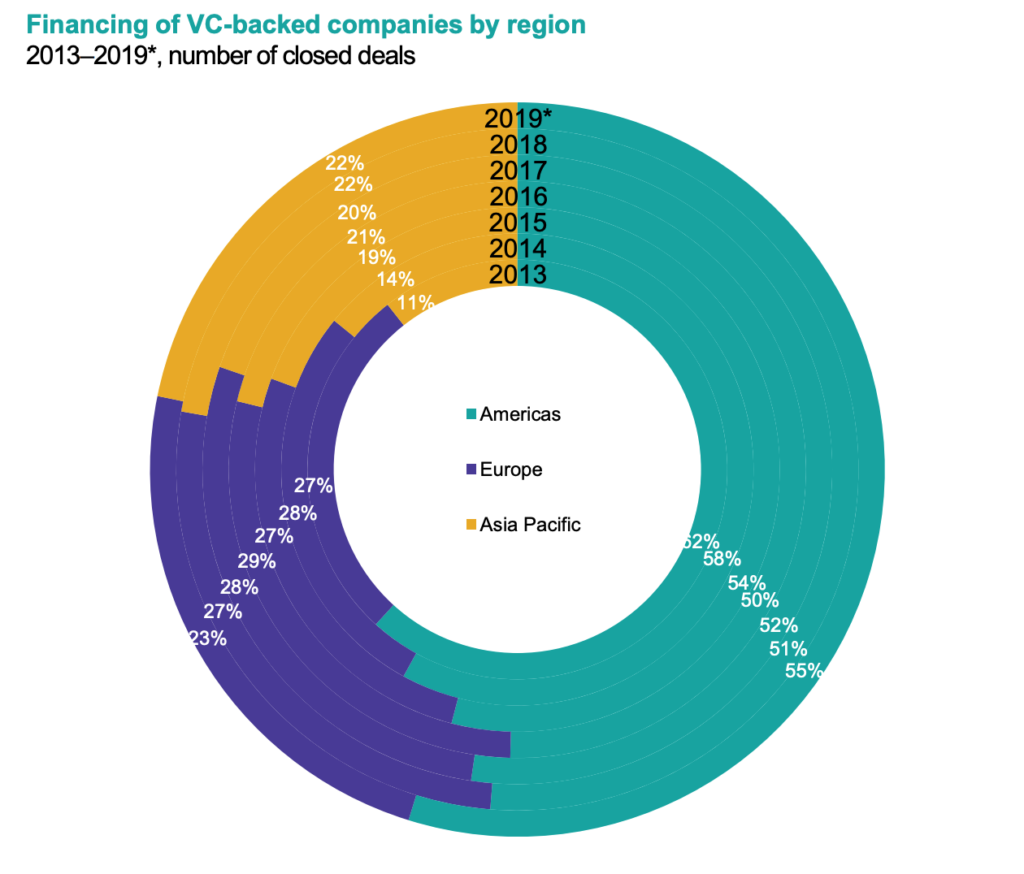

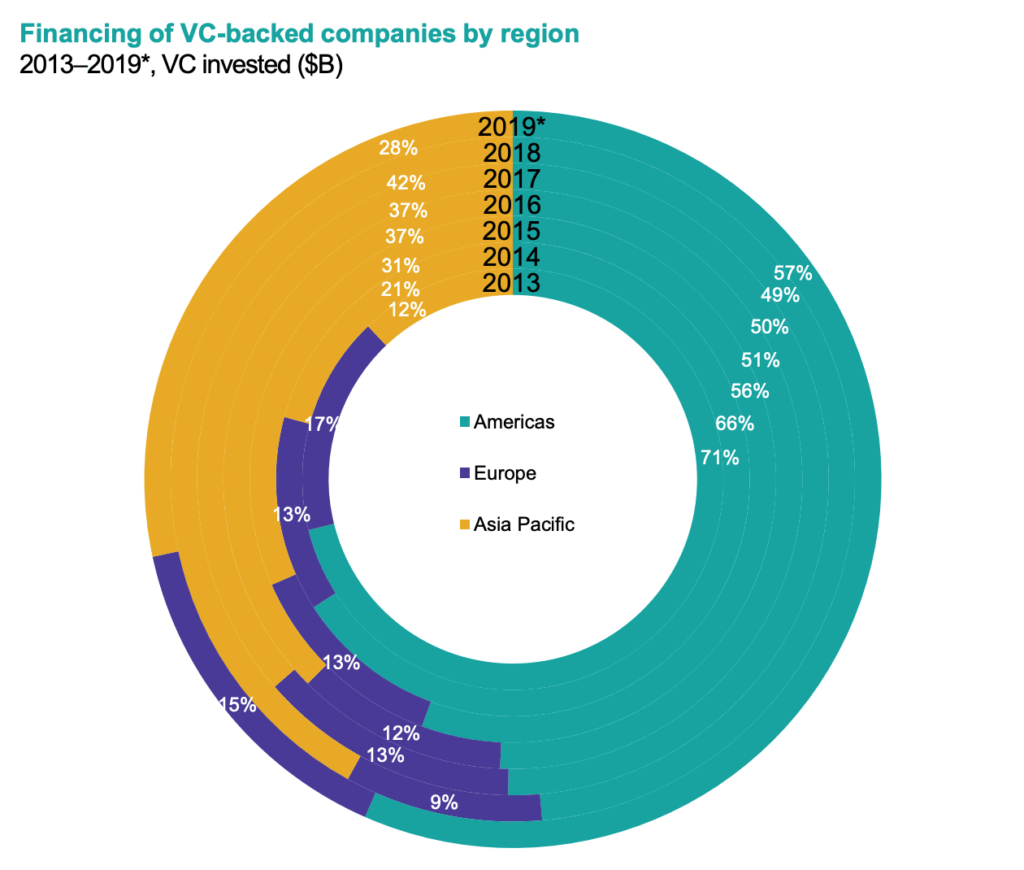

It appears that capital looks for international opportunity with less vigour when we look at business creation

And it becomes more striking if we look at the same chart in terms of value

KPMG VC Pulse Q4 2019

Investments are still very US skewed.

Are we living in the age of decadence?

Absolutely not. To the contrary technology is again fast approaching one of its transformative revolutions: the age of AI.

Society is ill prepared for the vast amount of economic and social disruption this new age will generate and is doing very little to anticipate and mitigate the effects.

At the same time, the ineluctability of the Silicon Valley’s funnel of value creation continues to relentlessly bake opportunities, but as it is forced to reach for the bottom of the barrel of ingenuity. As a result, more less than perfect endeavours are promoted to the investible ranks.

The solution?

Invest in this fund*!

Samantha will help you generate value 😃

For more blog articles

* no intention to provide investment advice here and only talking to accredited investors