Italy and EU: a love affair gone wrong

It’s time for Italy to leave the Euro. Italians have long been ardent supporters of the EU and notably among its founding members: the treaty establishing the EEC – European Economic Community – was signed in Rome in 1957.

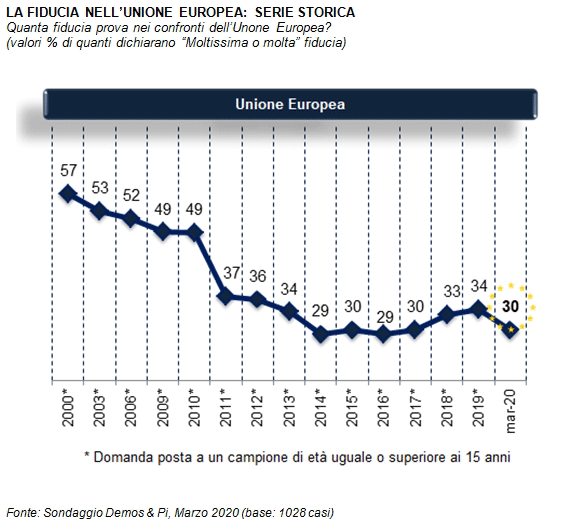

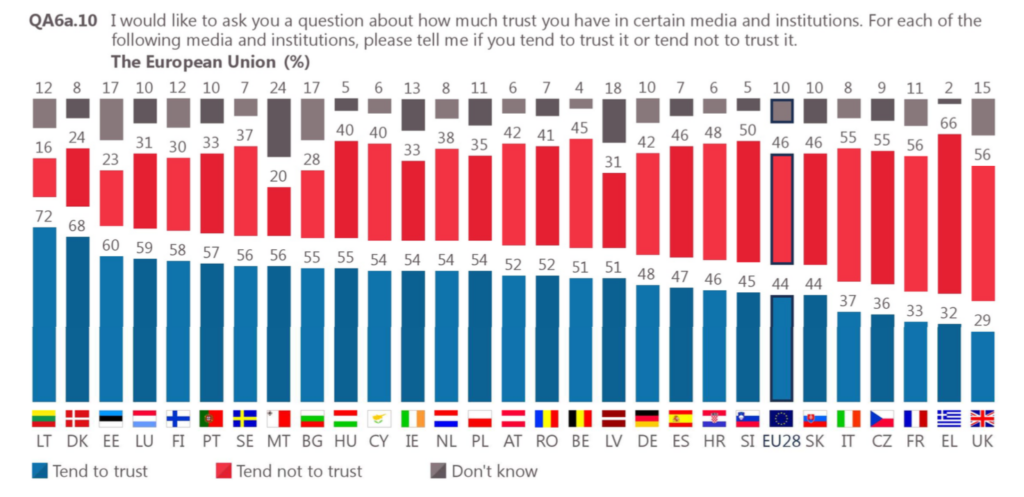

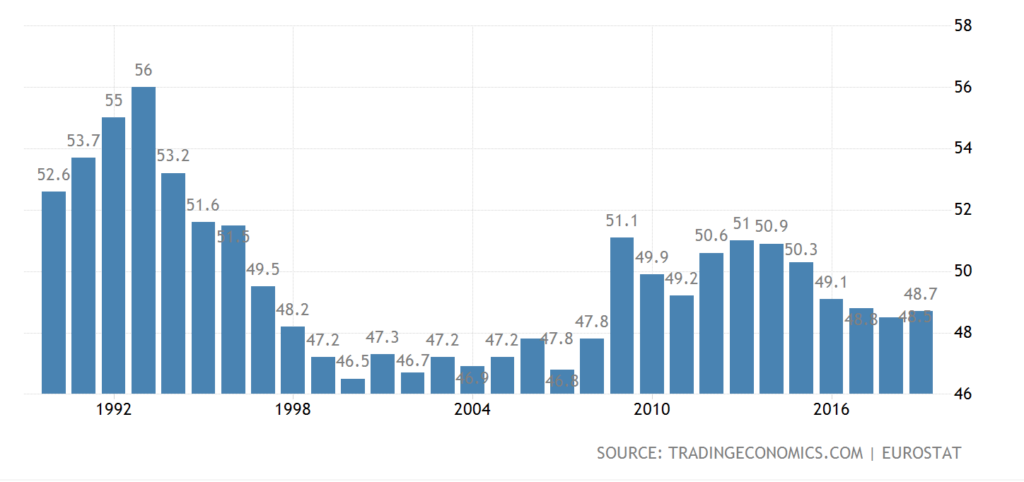

Unfortunately Italians are not the fervid supporters they used to be anymore: there has been a pretty unstoppable drop in support ever since the EU was founded.

Lack of growth at the heart of dissatisfaction

As anytime there is such an overwhelming evidence in support of a trend, we have to ask ourselves the reasons behind. In this case the answer is quite simple: the economy.

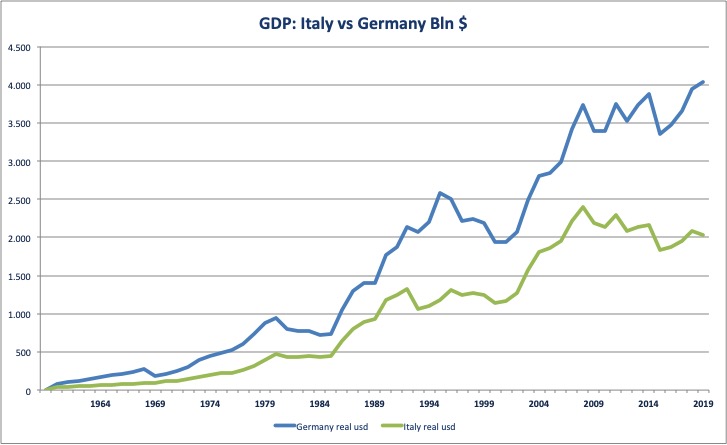

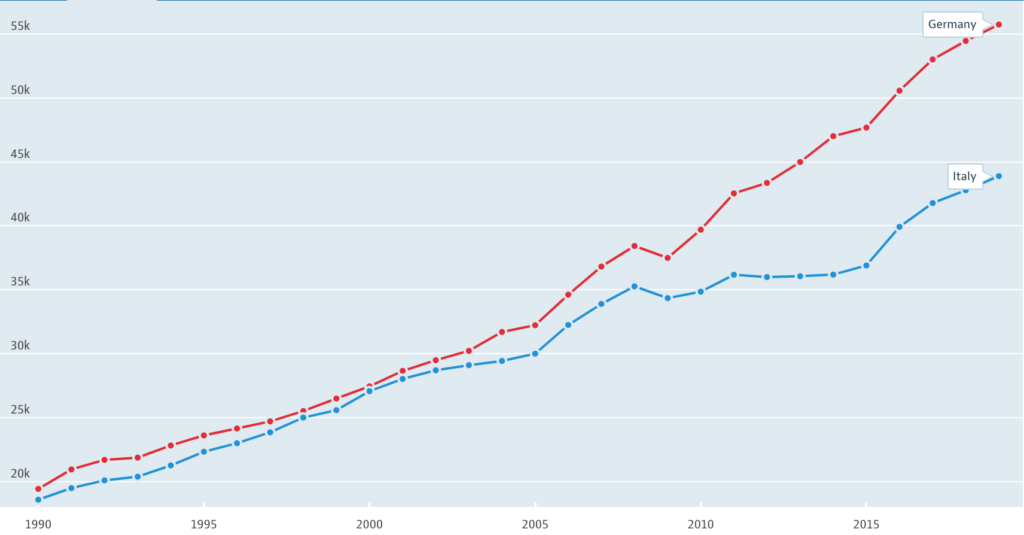

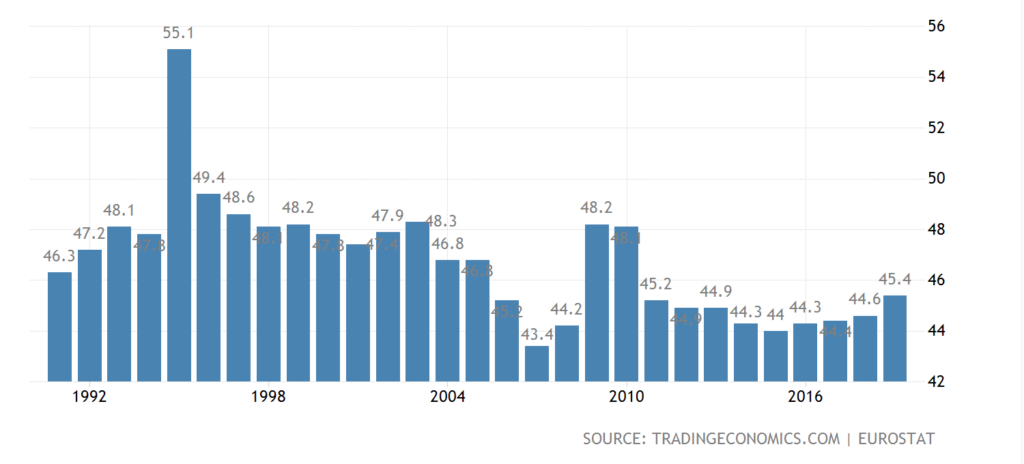

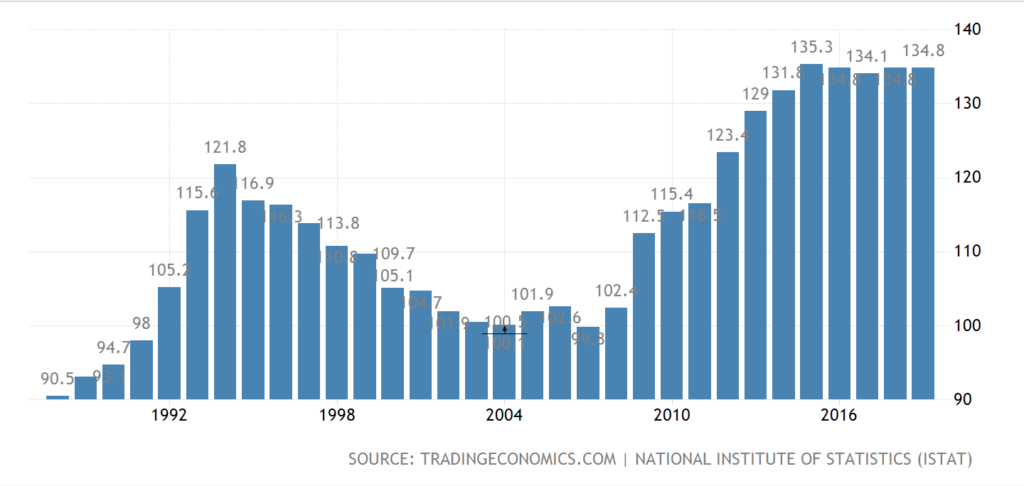

The performance of Italy’s economy has been strikingly poor since the formal establishment of the EU with the Maastricht Treaty in 1992 and has practically stalled since the introduction of the Euro in 2002. The spike around 2002-2010 has more to do with the exchange rate euro-dollar than with brilliant performances of the two economies.

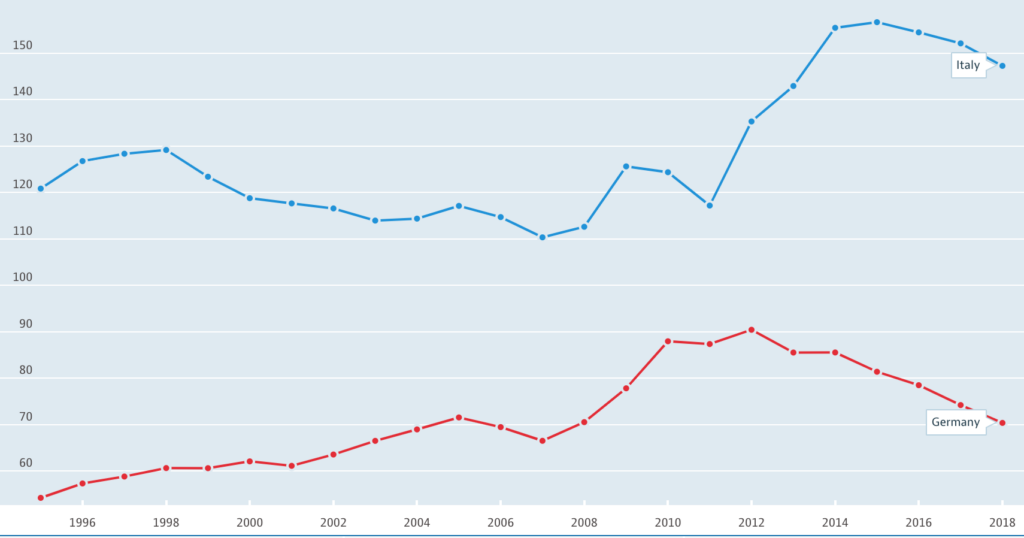

Germany’s and Italy’s appear shapes appear fairly similar after 1990, and this has to do much with the fact that GDP is quoted in usd. Germany has nonetheless been growing much faster

A comparative analysis of economic performance: Germany and Italy

The ratio of the size between the two economies went up from 1.5 in 1990 to 2 in 2020. By not having been able to keep the pace, Italy has foregone approximately 666 bln € of Gdp. In a population of 60 mln, that is approximately 8k € (in Italy, 80% of GDP is “final consumption”) per person per year of foregone wealth.

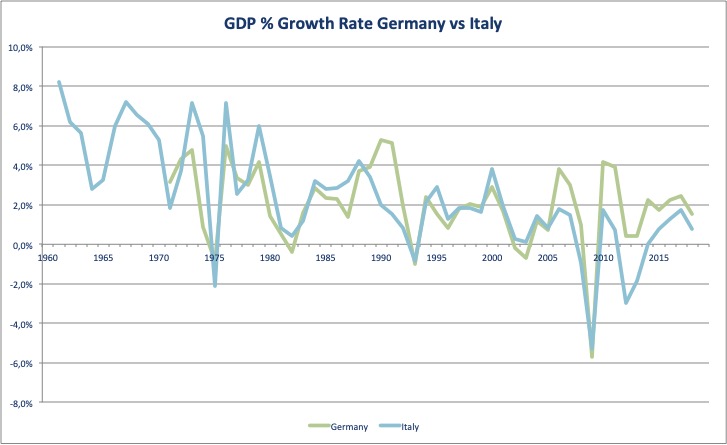

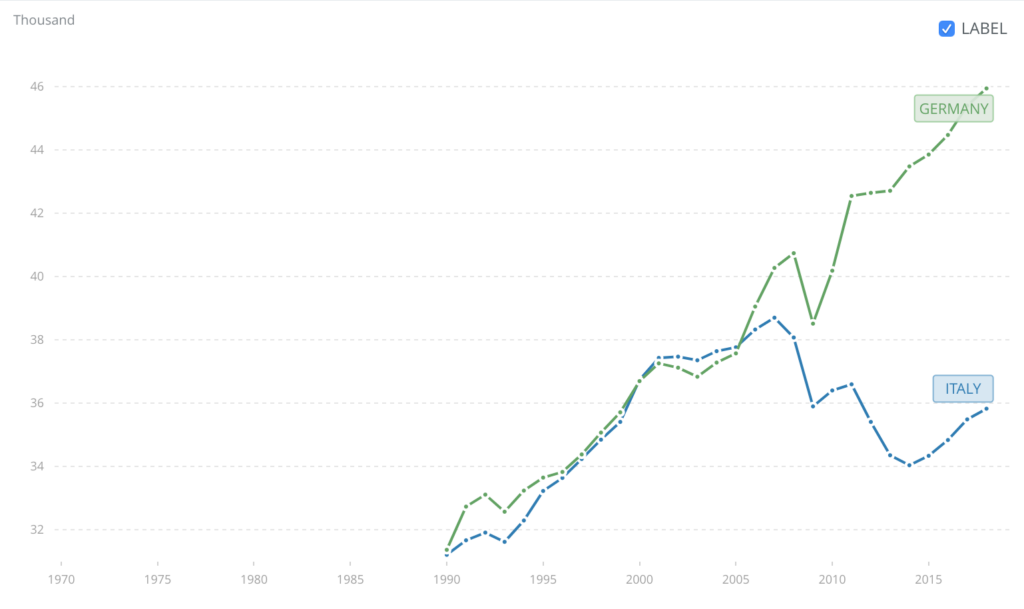

The same gap can be observed analysing Gdp growth (at current LCU) per year and comparing it to Germany’s.

Again, it is fairly visible that Germany has not experienced the almost 100 basis points drop in growth since the introduction of the euro.

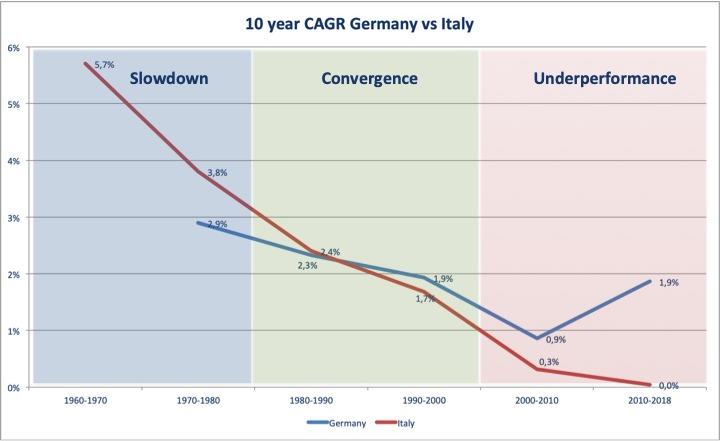

If we analyse CAGR – average growth – in three blocks preunification (1960-1985) Maastricht convergence (1985-2005) and posteuro (2005-2020) we observe a steady fall in growth rates for Italy. Germany suffered the effects of the 2008 financial crisis, but other than that has been performing quite strongly.

Italy’s economy: a stalled growth machine

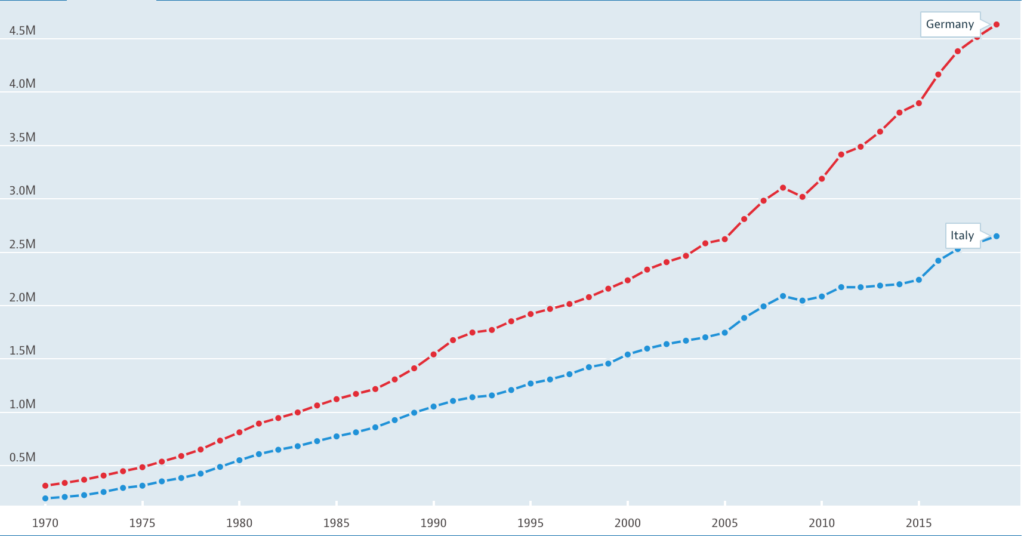

Even more striking are the differences if we analyse GDP in constant terms

A country to country comparison makes it very visible that while Italy was tracking Germany’s growth until 2000, it has been always underperforming ever since.

If we adjust for purchasing power and switch to usd, we see that Italians have lost spending power in the last 15 years.

It thus comes with no surprise that the net positive scores (positive – negative) of feelings towards EU in Germany and Italy show an ample difference: +6 for DE vs -18 in IT.

Government spending and public debt

We laid out the basic economic facts, now let’s delve into the reasons.

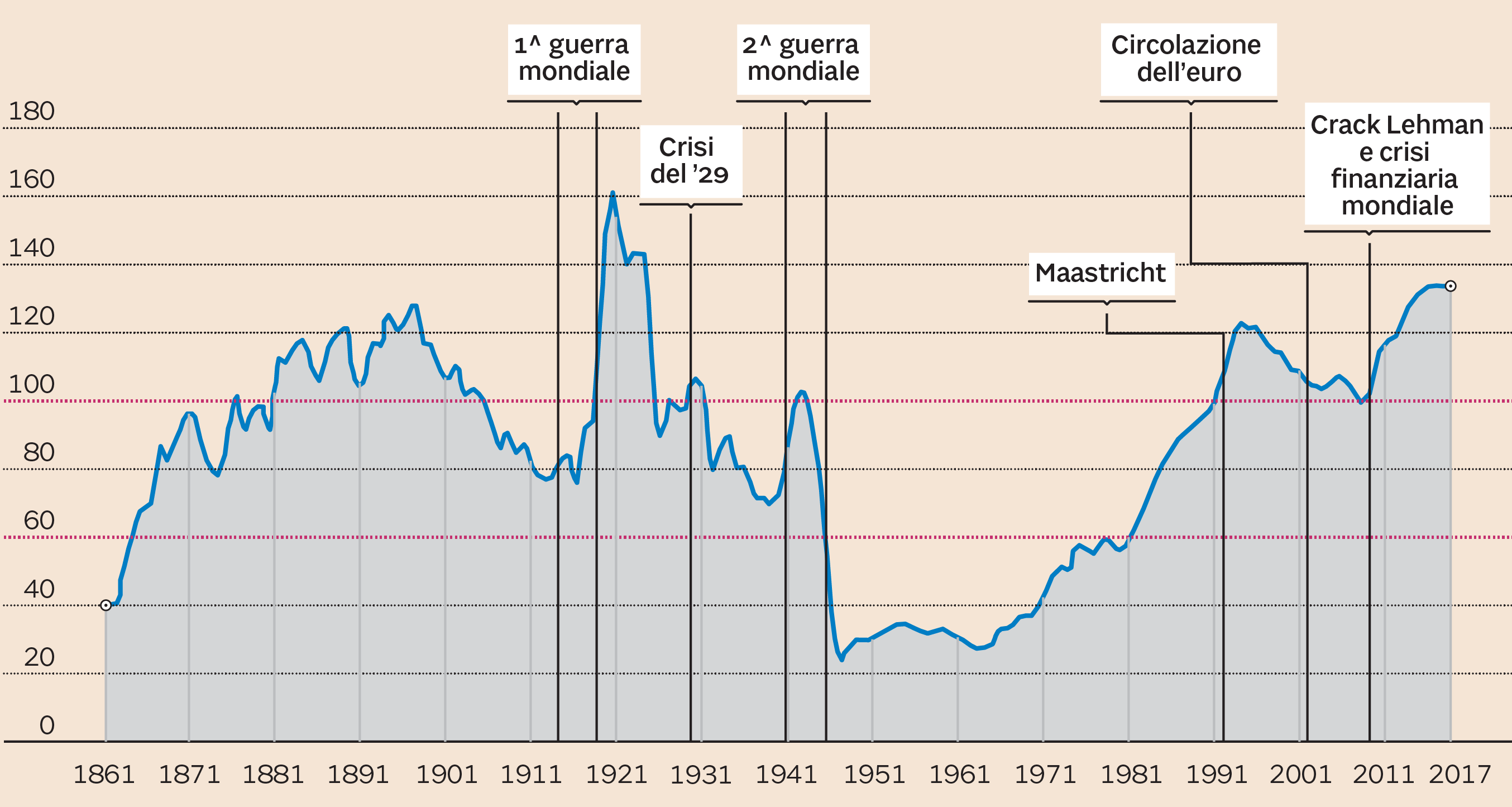

The customary tale is that by joining the euro Italy has foregone the opportunity to consolidate its debt and adopt the much heralded “structural” reforms to enable its economy to flourish.

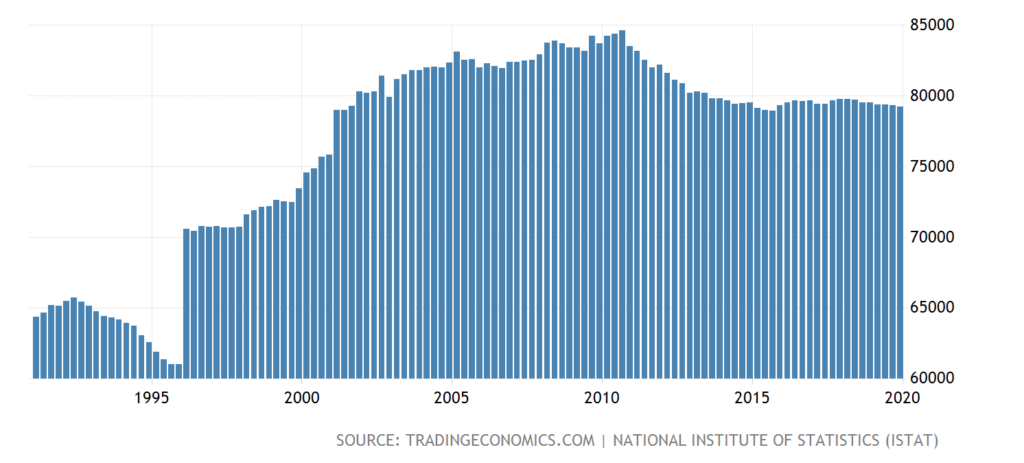

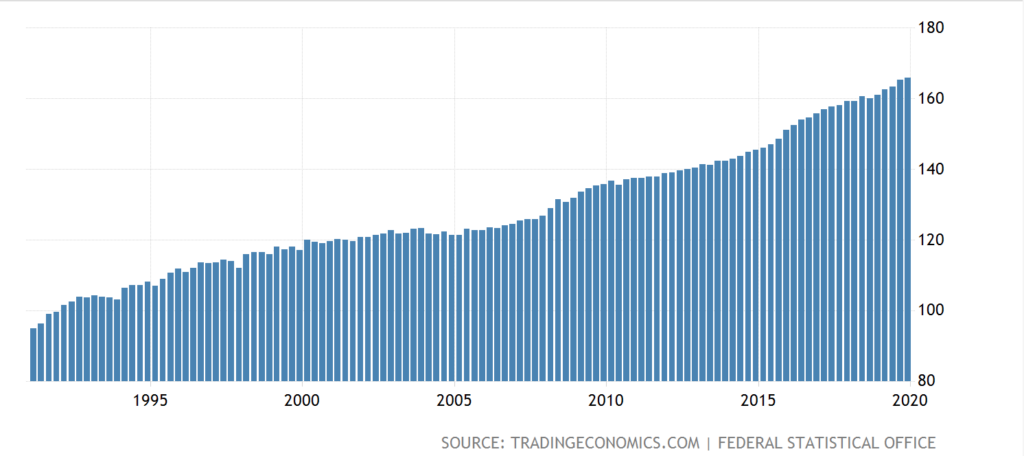

Let’s now take a closer look at what happened with debt in Italy in the last 40 years and compare it again to Germany. We can appreciate since the 1990’s a great deal of attention in Government spending as an effect of the Maastricht criteria for budgeting. Spending has plateaued around 80 bln € quarterly, or 320 bln yearly.

Germany’s spending during the same period has increased by over 50%, compared to Italy’s more modest 25%.

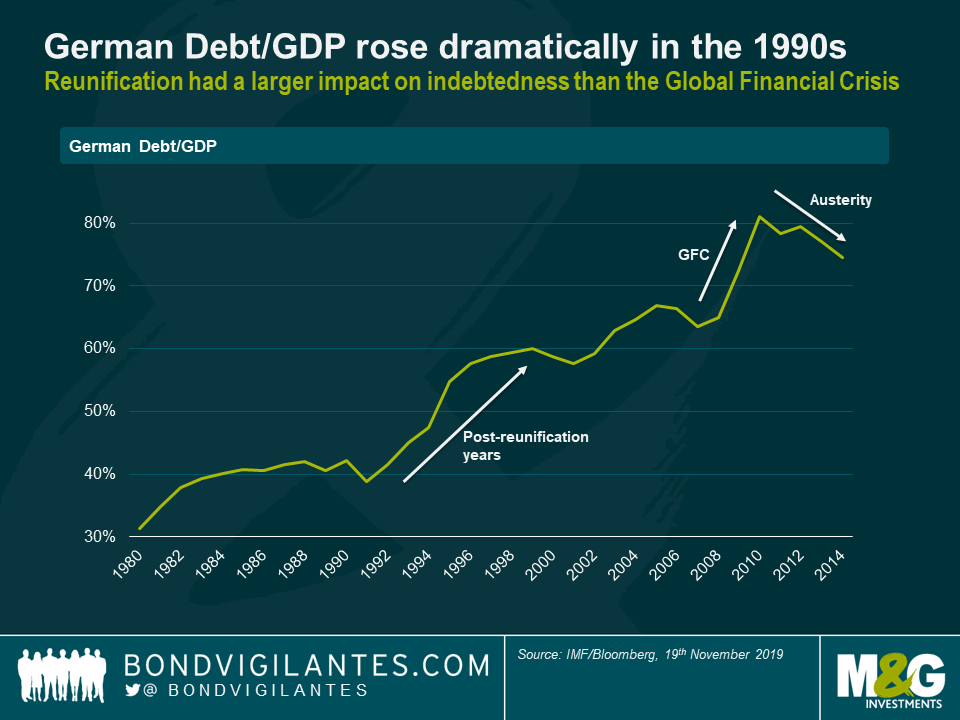

This increase in spending does flow in the debt to GDP figures, that appear quite similar for both countries, as Germany’s economy has kept growing – as we have previously seen – at a steadier pace.

The toll of interest payments on the economy

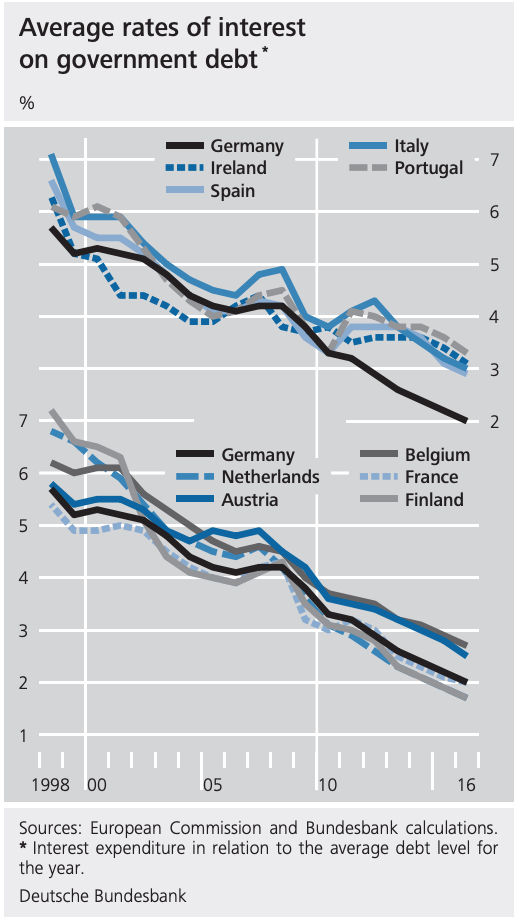

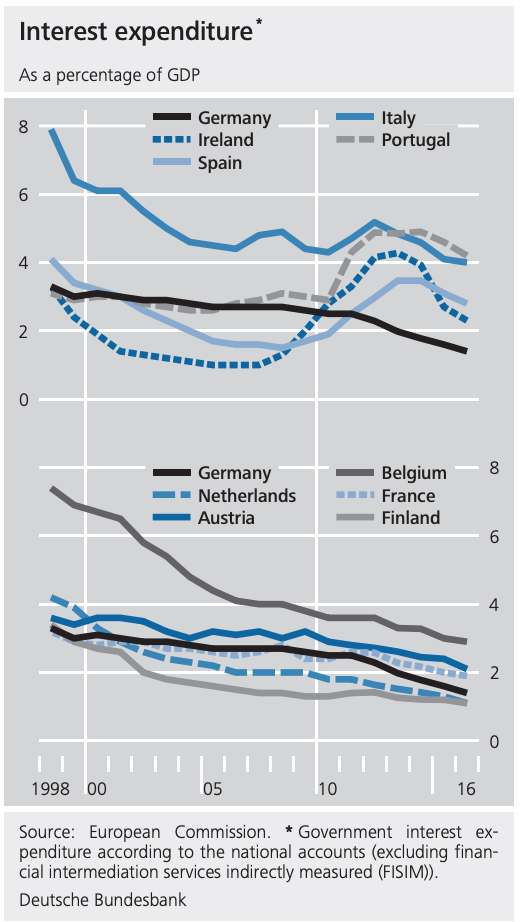

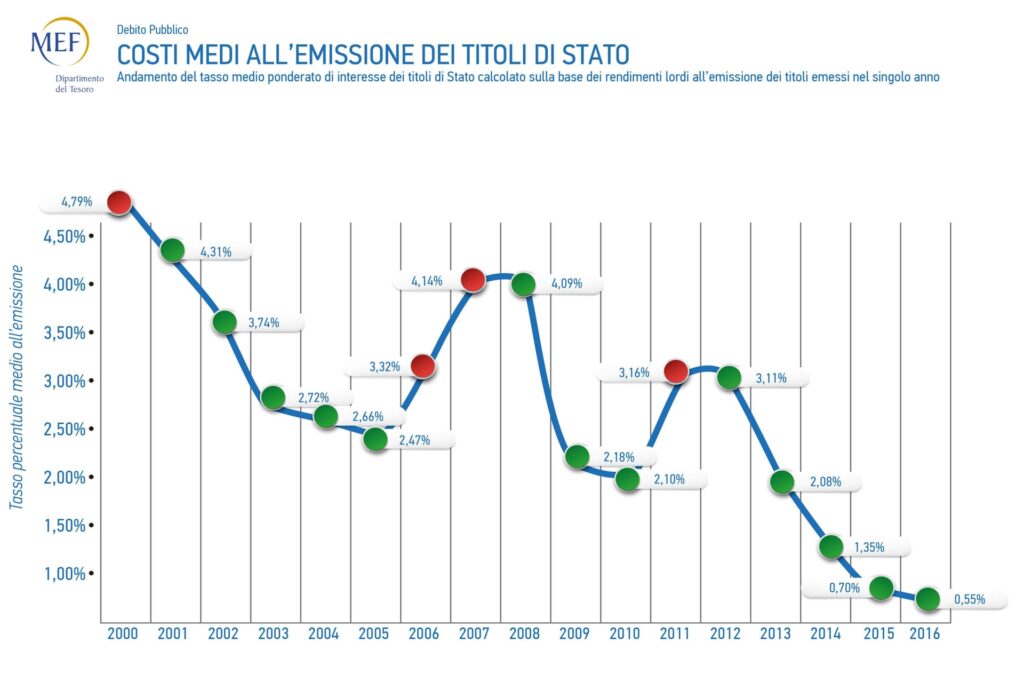

This difference in interest payments throughout Europe involves very different availability of budget in the different countries. As the cost of issuing debt in Europe has gone down by 3 to 4 per cent on average in 20 years, we still observe very different costs of debt servicing in Europe.

Italy – compared to Germany – has almost 2.5% GDP of additional interest payments to face every year. After adjusting for the different size of the two economies, that is an extra 50 Bln € per year. This is money that does not flow back into services or investments, that as we will see have shrunk almost to zero.

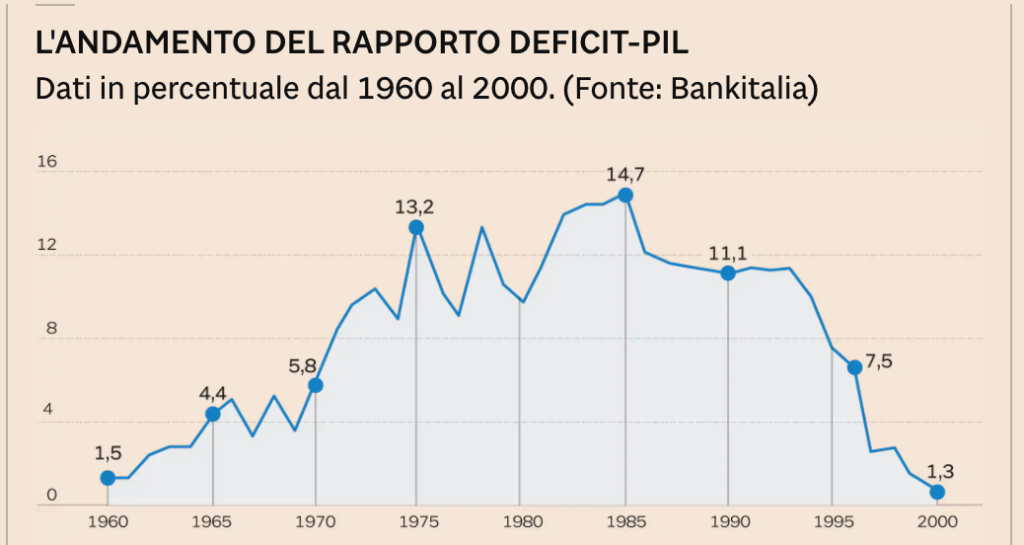

This gap in interest expense goes back to a long period of unbalanced budgeting during the 80’s and 90′.

Lower interest rates or growth?

From the cost of debt graphs it appears that Italy should have enjoyed important savings from joining the euro: interest payments dropped by almost 4% GDP between 1996 and 2020. Average cost of debt has dropped from 5% to 0,6%.

Alas, what was the cost of this cheap money? Growth!

It was paid very dear in terms of lost growth.

Once we take exchange rates, inflation and purchasing power out of the equation we see that Italy has actually stagnated for now over 10 years.

The reason has little to do with structural reforms.

The small size of Italian firms, bureaucracy, productivity, political instability, the slow judiciary system are normally held accountable as signs of structural inadequacy. They appear instead more as long term characteristics of the Italian esprit du peuple and particularly undesirable characteristics of the Italian nation. Besides, these issues were already affecting the economy in the 50s, 60s and 70s. Some of them were considered the reasons behind Italy’s success story: they cannot thus be considered – at the same time – the reasons of the slowdown.

It is rather the change of monetary policy objective the only noticeable difference: swapping inflation for currency stability in the late 80s.

A short history of Inflation

After years of currency devaluation, when the US and consequently most other countries changed tack in monetary policy and started pursuing monetary stability and low inflation as a monetary policy objective. The Ecu initiative was lunched in Europe that eventually led to the Euro.

In the late 70’s inflation started to be perceived as a problem in the Oecd economies, in the aftermath of the oil shock. Soaring prices were eating into the spending power of consumers and increasing the cost of raw materials and semi-finished products to manufacturing economies. Until the beginning of the 1980 Bank of Italy (BoI) and the Italian Treasury were closely linked. Any debt issued by the Italian Government would be guaranteed by the BoI. Starting in the 1980 this tie was progressively loosened up, granting full autonomy to the Bank and transferring the responsibility of debt purchasing exclusively to the markets.

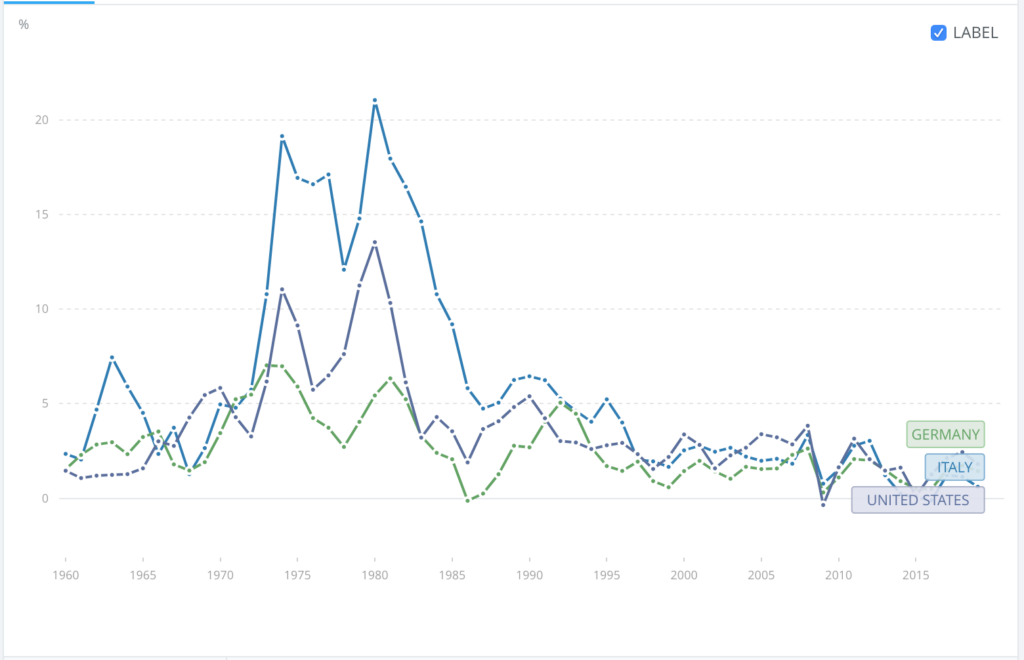

As the inflation graph clearly shows Germany has historically pursued a stable currency policy, possibly an effect of the traumatic post war hyperinflation experiences during this century.

However in practice who is set to draw the most benefits from a stable currency? Obviously a lender, not a borrower. If a euro tomorrow is worth less than a euro today, a borrower is effectively better off. This applies to both consumers, companies and governments.

Italy approached the 80’s in a debt position not too dissimilar to Germany’s, with debt around 50% of GDP

Inflation in the US, Germany and Italy

It’s hard to find a unique source for historic debt levels for different countries and for Germany I could only find as far as 1980.

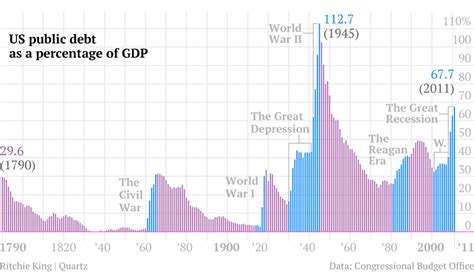

Even limiting observation to this limited timeframe, we see that inflation was causing debt to rise in most countries, with different starting points: 25% for the US, 30% for Germany and 60% for Italy.

If we take a longer historical perspective, Italy’s has long been struggling with high levels of debt. The situation was brought back under control after world war II incidentally using inflation!

When inflation reached 40%, it did impose great sacrifices on the population, but it also cured the debt problem. In a just few years it went down from 100% of GDP to only 20%, the unburdened precondition to the “Italian Miracle”, the economic growth dash of the 50’s and 60’s.

Government deficits and levels of debt

If we analyse only the last 30 years, we see that the tighter budget regulation imposed with the Maastritch criteria to participating EU countries initially favoured a great deal of debt reduction. This ended around 2005 when the sheer mass of the debt accumulated and its unrelenting growth out-weighted the advantages of the lower interest rates. The policy enacted for inflation control made it now impossible to inflate the debt away. Germany, starting on a lower level of debt, was on the contrary able to expand its debt and finance its reunification. After a peak in connection with the Global Financial Crisis of 2008, Germany was able to bring its debt problem back under control. As we have previously observed it was able to do so without at all reducing its government spending and enjoying real terms negative interest rates on its public debt along the way.

On a separate account, how did these high levels of debt originate – in Italy and elsewhere – in first place?

Well, it goes back to the post oil shock inflation ridden economy of the mid 70′ to mid 90′ where governments were consistently running deficits, supported by the high levels of growth that we has seen above. A growing debt in a growing economy is not much of a problem, if the cost of financing is maintained below the growth rate of the economy.

But growth spoiled the politics in Italy, creating a resource devouring machine of welfare and public spending obligations. Once designed for largesse, it was was hard to retrain the administration machine to more cautionary spending.

The options, now

The options are now very limited. While a low cost of debt financing is almost taken for granted, there is no room to issue more debt, as it already eats over 4% of GDP in interest expenses. As debt spiralling out of control always calls for more debt, the way out for Italy cannot be demanding unlimited purchasing power from the BCE or conditional or unconditional acceptance of more lending.

Covid19 has possibly made the issue more pressing: unlike other countries Italy cannot print helicopter money or further increase its debt position to stimulate an economic recovery.

The way out is to regain monetary sovereignty and to transfer back the role of lender of last resort to the Bank of Italy. Foregoing the euro won’t be easy and should be carefully planned, but acted fast. An independent currency would immediately devaluate with respect to the euro and international currencies, reducing households spending power by as much as 20%. However, the adjustment would also relaunch Italian exports and increase sales more than costs, as in any value adding economy with a clear vocation for exports.

This is why it’s time for Italy to leave the euro.

It will be hard, it will be long but it will be doable.

On the other hand, this path of rising debt leads to nowhere.